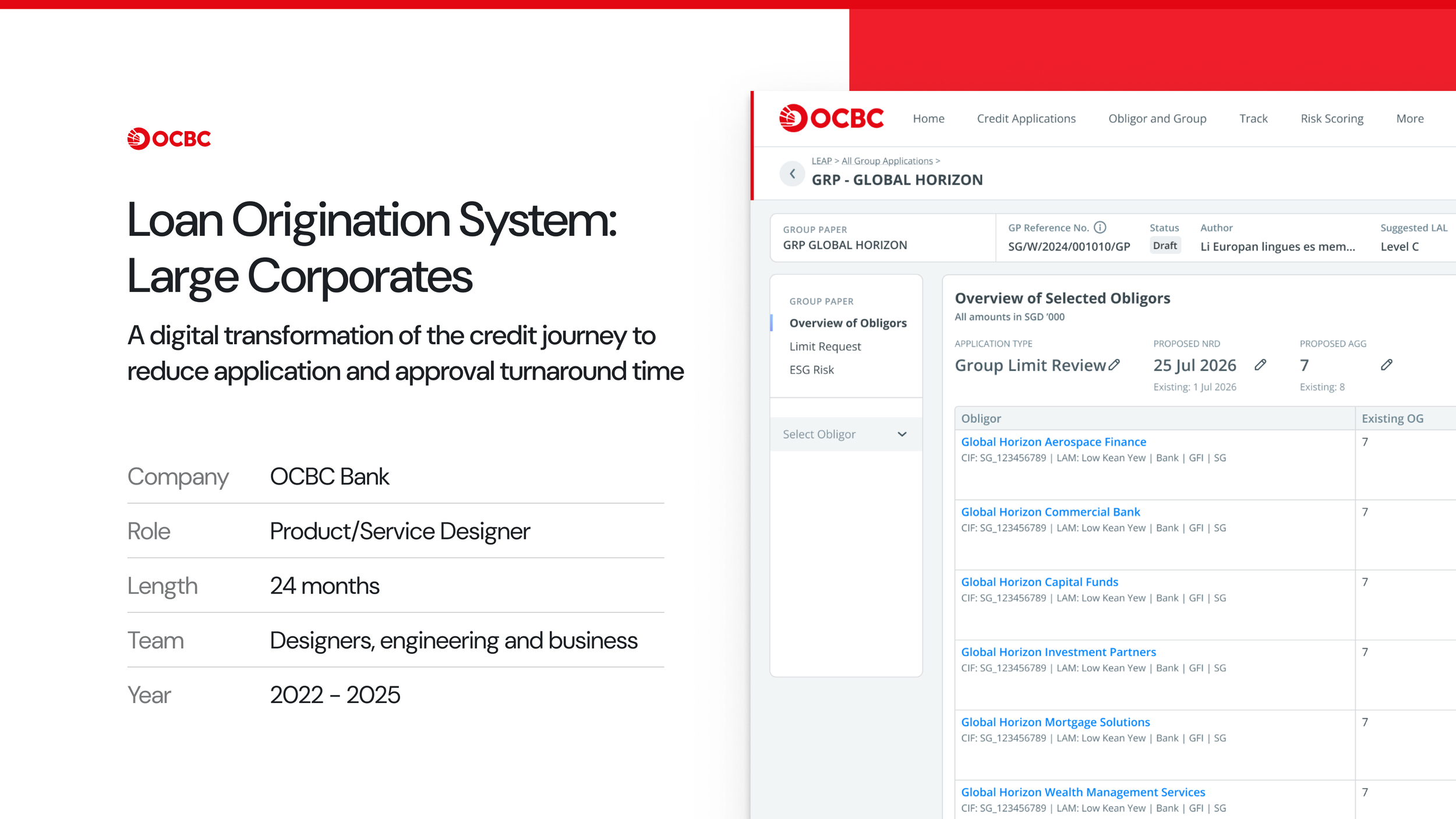

OCBC Loan Origination SystemA digital transformation of OCBC’s credit journey to reduce application and approval turnaround time

The Loan E-Application Platform (LEAP) is the Loan Origination System for OCBC’s Large Corporates, Enterprise and Emerging Business segments. Business loans make up 65% of the loan book (roughly SGD 197 billion) in H1’24.

The design team is made up of 4 other designers, with backgrounds in Service, UX and UI. We worked closely with the Business/Product team of 7 business users turned into Product Owners, 2 scrum masters, 2 business analysts, 12 squads of engineers and 5 subject matter experts.

Our stakeholders and sponsors were the Head of Global Wholesale Banking, and Head of Credit Risk Management in OCBC SG.

My role included service and product design. I led the end-to-end design for multiple modules within the system while ensuring a congruent overall solution. A bulk of my work includes facilitating discovery and ideation workshops and co-creation sessions and the production of development ready screens.

As the project team was newly formed, I established design processes and artefacts to align business, tech, and design teams, and guided newly converted POs on design thinking, agile methodology and basic user stories/requirement gathering. I also guided other junior designers across various parts of the design methodology framework.

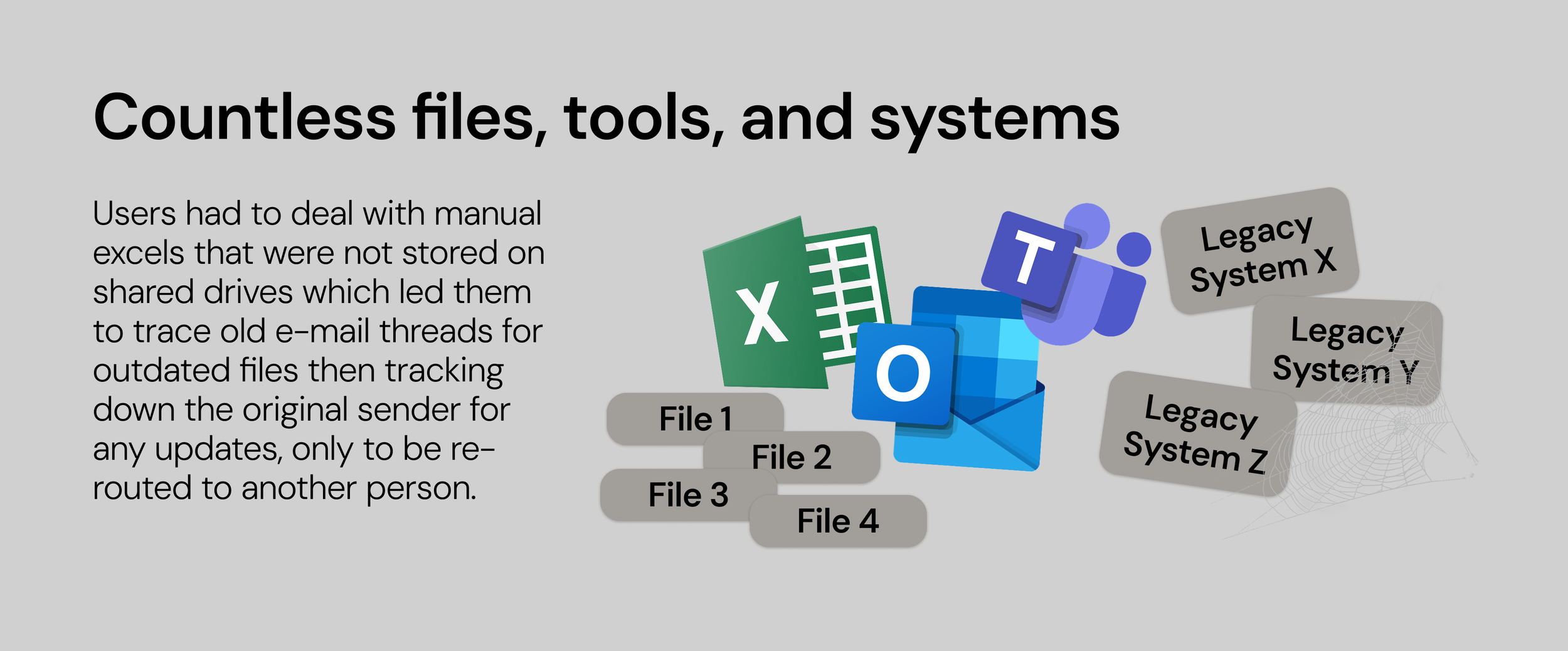

Why was the digitalization important?Instead of spending time on value adding work,

Relationship Managers (RMs)

Spent 59% of their time on processing/reporting instead of client management and sales

100+ files

7+ tools, software used per application raised

high volume of manual, administrative paperwork

a lot of report generation

no single source of truth for latest info

Approvers

Cognitive load on format checking instead of managing risks. Returns for formatting and data quality issues were the most common.

unnecessary manual scrubbing for basic hygiene of paper

returning papers due to formatting issues

Business Banking Credit Admin

Small team of <10 bogged down with out-of-scope formatting and data quality issues; operational risk

unclear scope

overwhelmed with manual inputs

manually tracking tasks

delays due to transposition errors

unproductive maker-checker roles

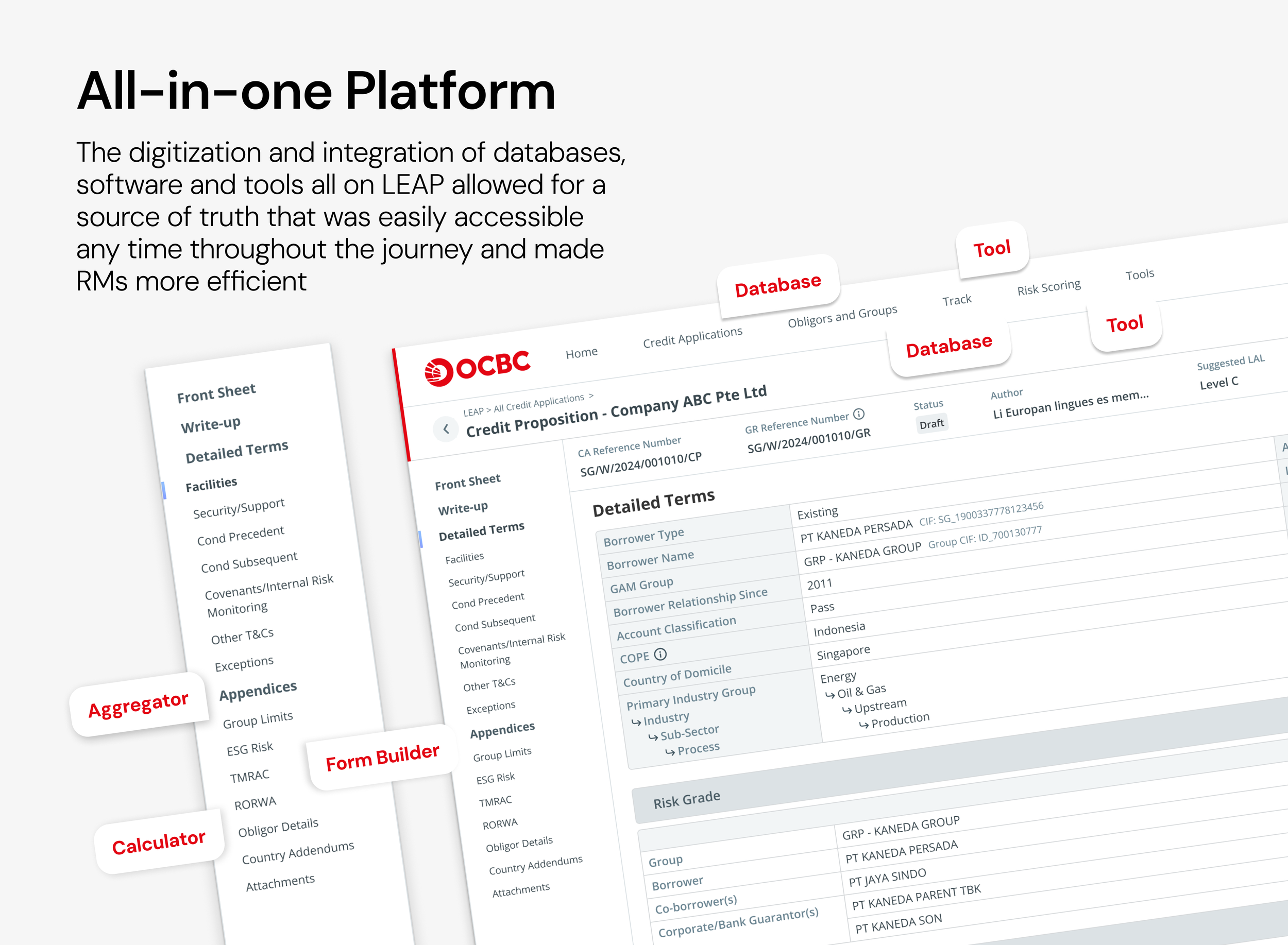

By digitalizing the end-to-end credit journey, we can reduce time taken to raise a credit proposal and speed up credit decisioning, thus allowing RMs and Approvers to focus on revenue generating work

Goals

Reduce manual hand-offs in credit process

Reduce manual, repeated, error prone entries

Reduce number of tools/software used

Objective

4.5 or higher ESAT score

Enable Straight-Through Processing (STP) where possible

0 repeated entries

Launch within 2 years

1 system to handle entire credit origination/approval

These objectives and goals directly supported OCBC’s goal to digitally transform core banking systems.

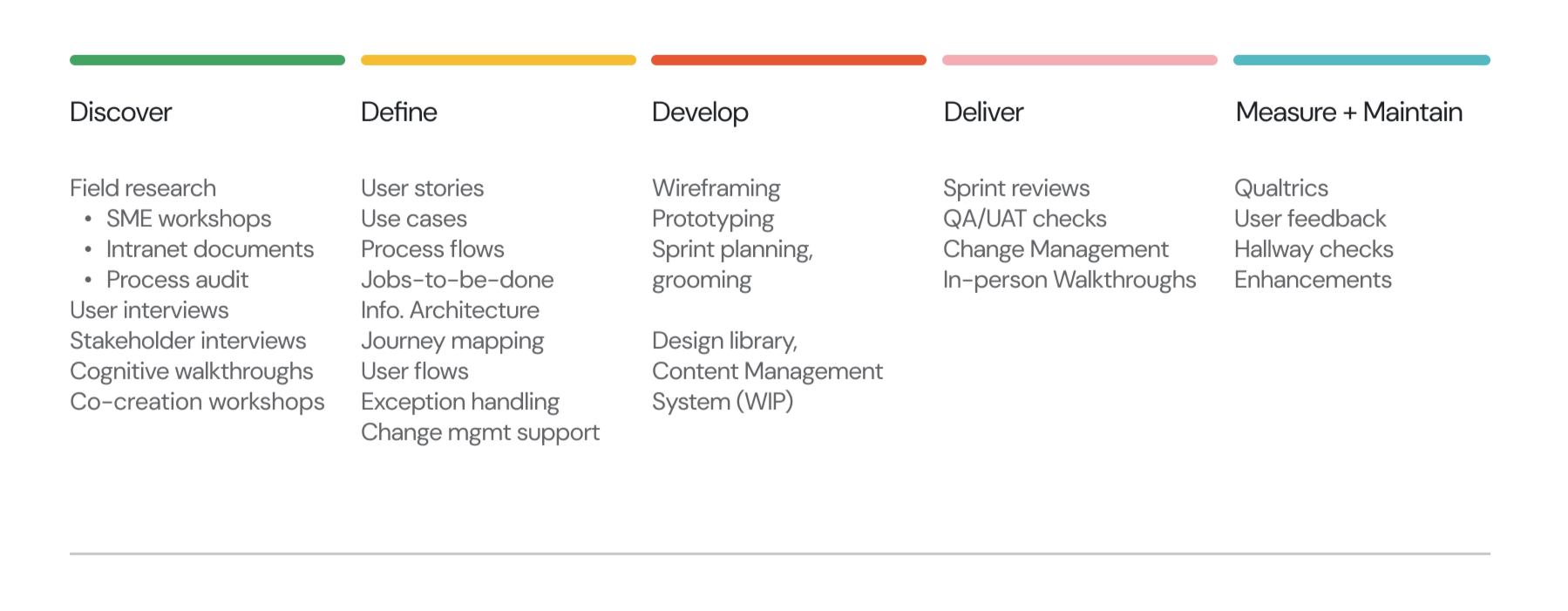

Process & Methodology

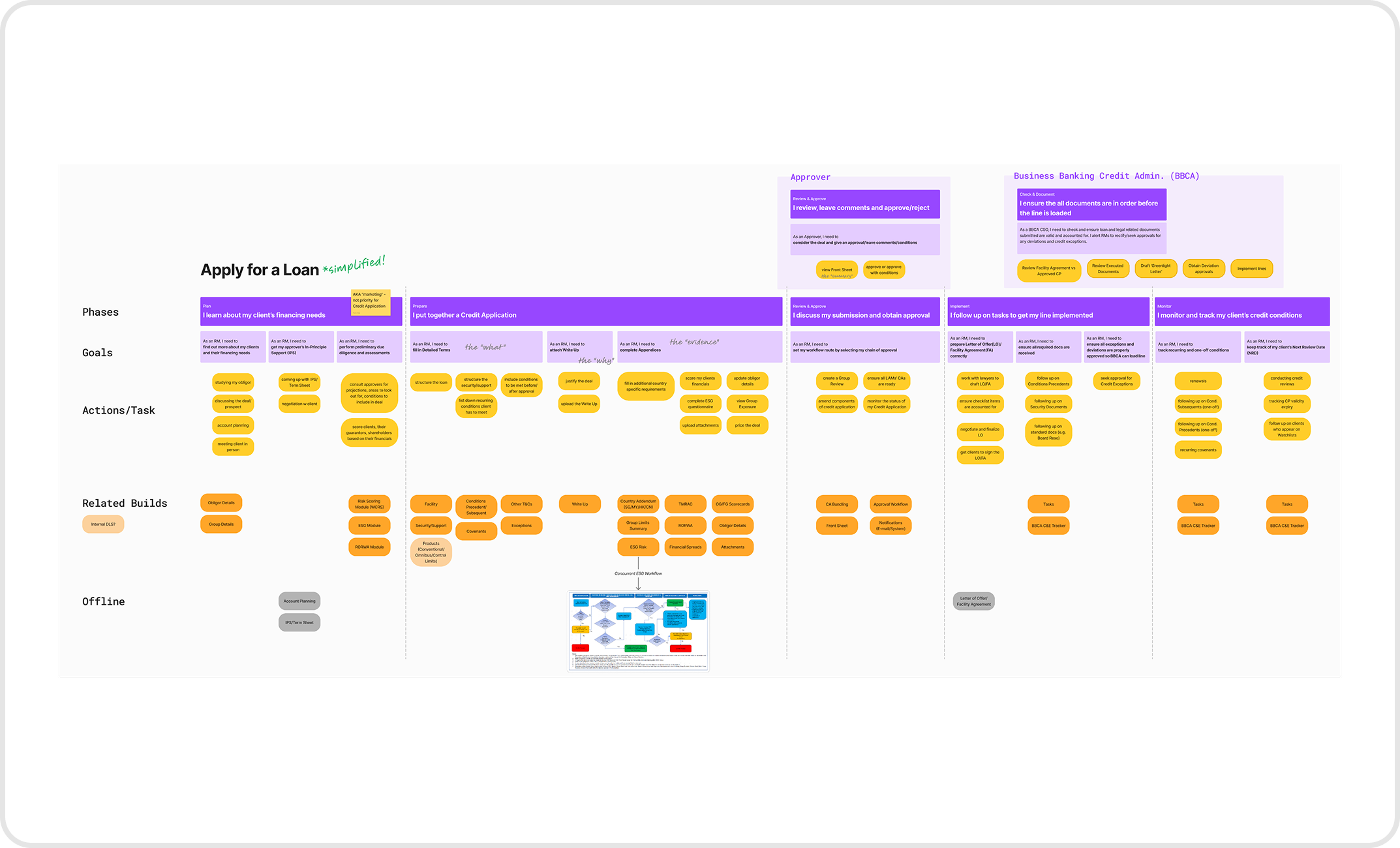

Journey Mapping

Mapping the journey allowed designers, business and tech to learn, align and understand how their work contributed to the system - which contributed to the journey.

It was an easily understandable artefact to onboard users and communicated the continuity and impact of their work.

Co-creation Workshops

Go-to tool for this project as it allowed us to brainstorm, discover, and validate easily. Especially since the subject matter was abstract and complex, it allowed everyone to collaboratively visualize concepts and solutions.

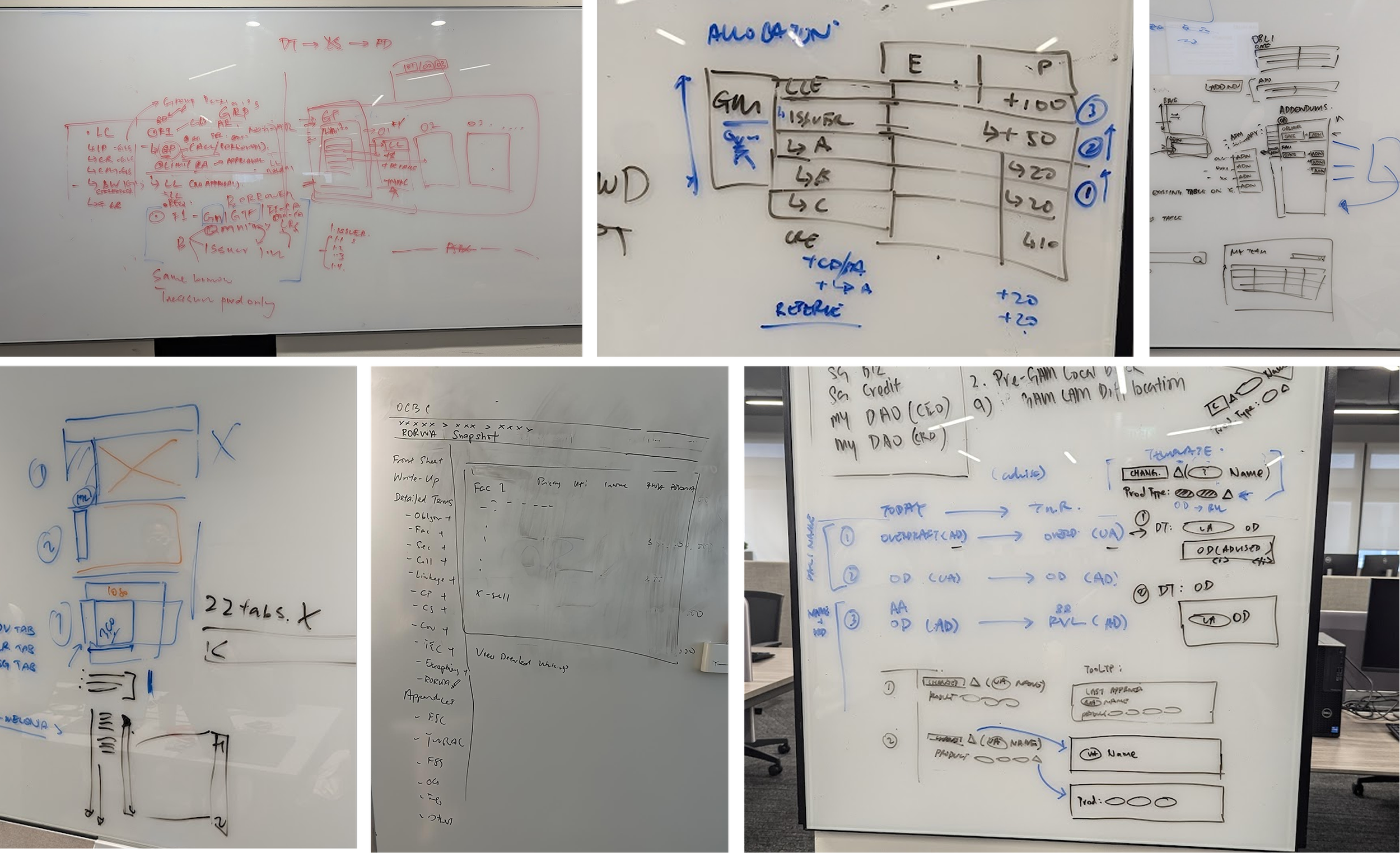

Whiteboarding

Most of the complex business scenarios and tech solutions were easily understood with simple sketches. Collaboration and aligning everyone’s understanding was much easier when we had a shared visual on the board.

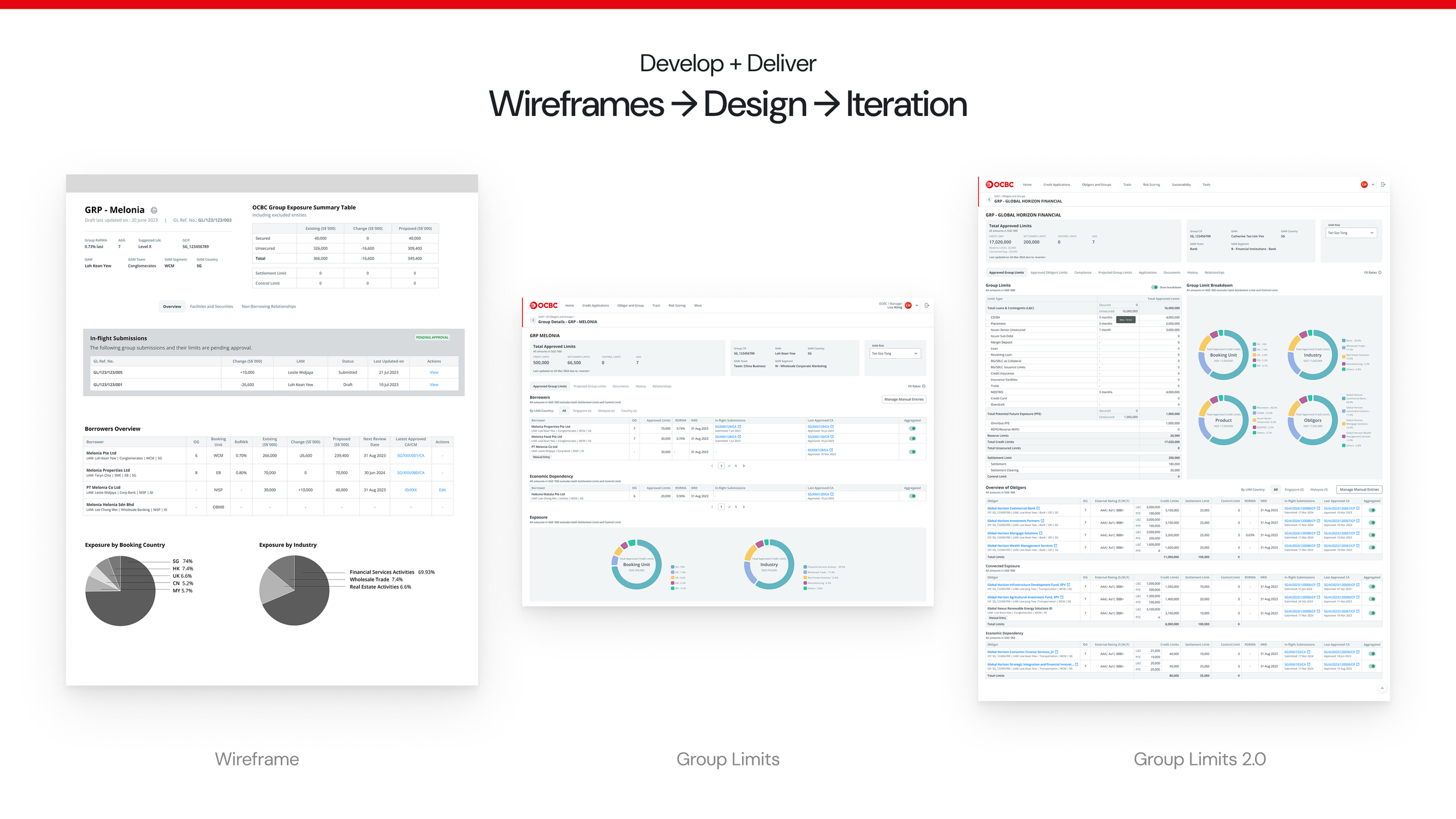

Wireframes

Solutions would be iterated based on user and stakeholders’ feedback. When gathering feedback, we focused on usefulness and usability. We would ensure all information needed was there, check that users were interpreting data as expected, uncover how it might be more useful and if this would meet their BAU requirements or if they had to do more things outside of the system.

We would take their feedback, weighed the trade-offs, and incorporated what was business critical.

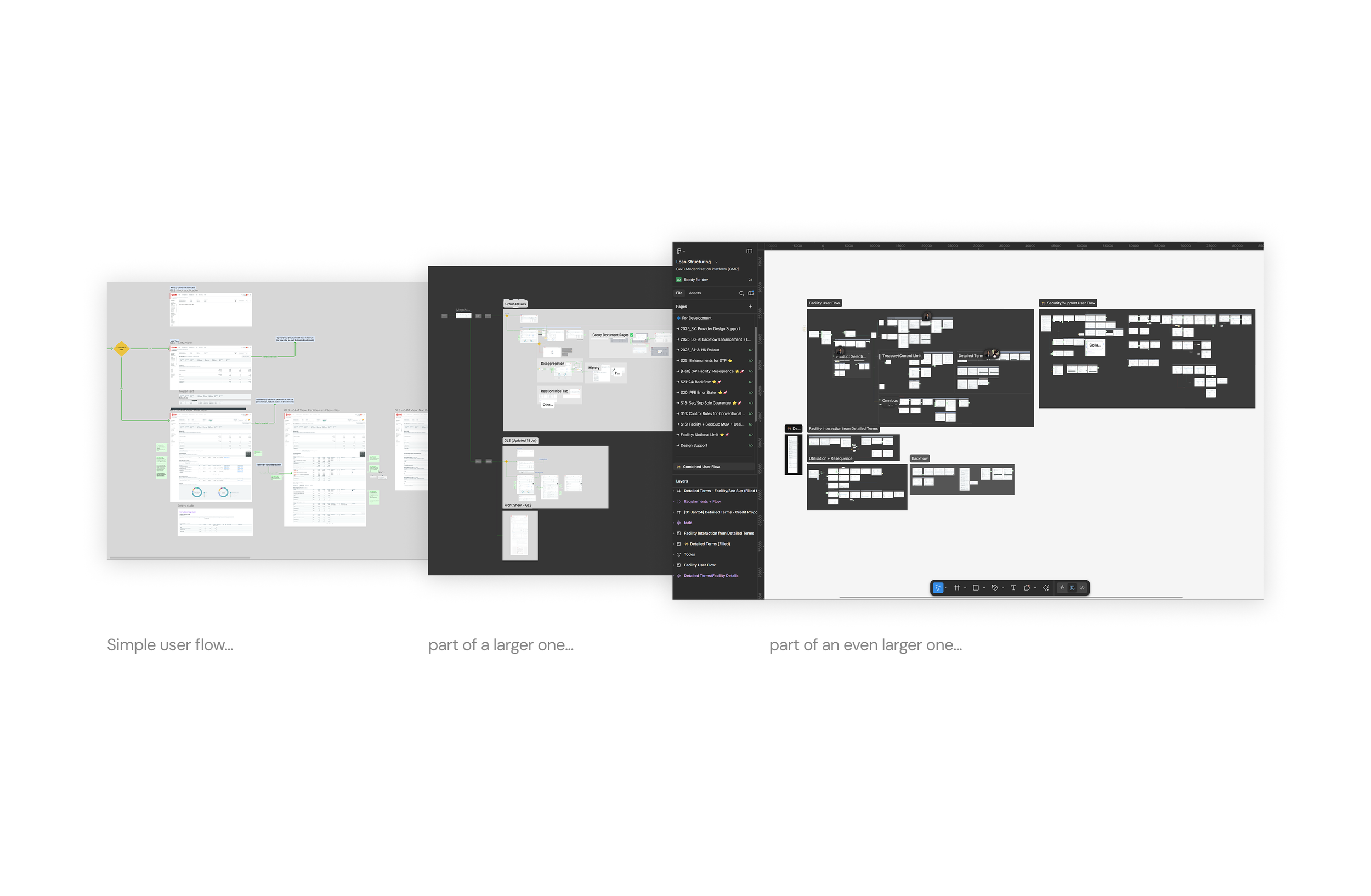

User Flows

Putting together user flows helped to visualize the solution. POs and BAs would use the flows to help scrub through the solution and think of exceptions or alternative handling, and would sometimes be used to share a solution to stakeholders. Ultimately, the user flows would detail interactions for engineers to understand how to build the solution.

Launch

As part of the launch and change management of the replacement of OCBC’s LOS, multiple in-person walkthroughs were conducted in Singapore, Malaysia, Hong Kong, and China. The walkthroughs highlighted key features, new ways of working, and process changes. Time was also catered for attendees to ask questions about the upcoming changes, which the team were on standby to answer.

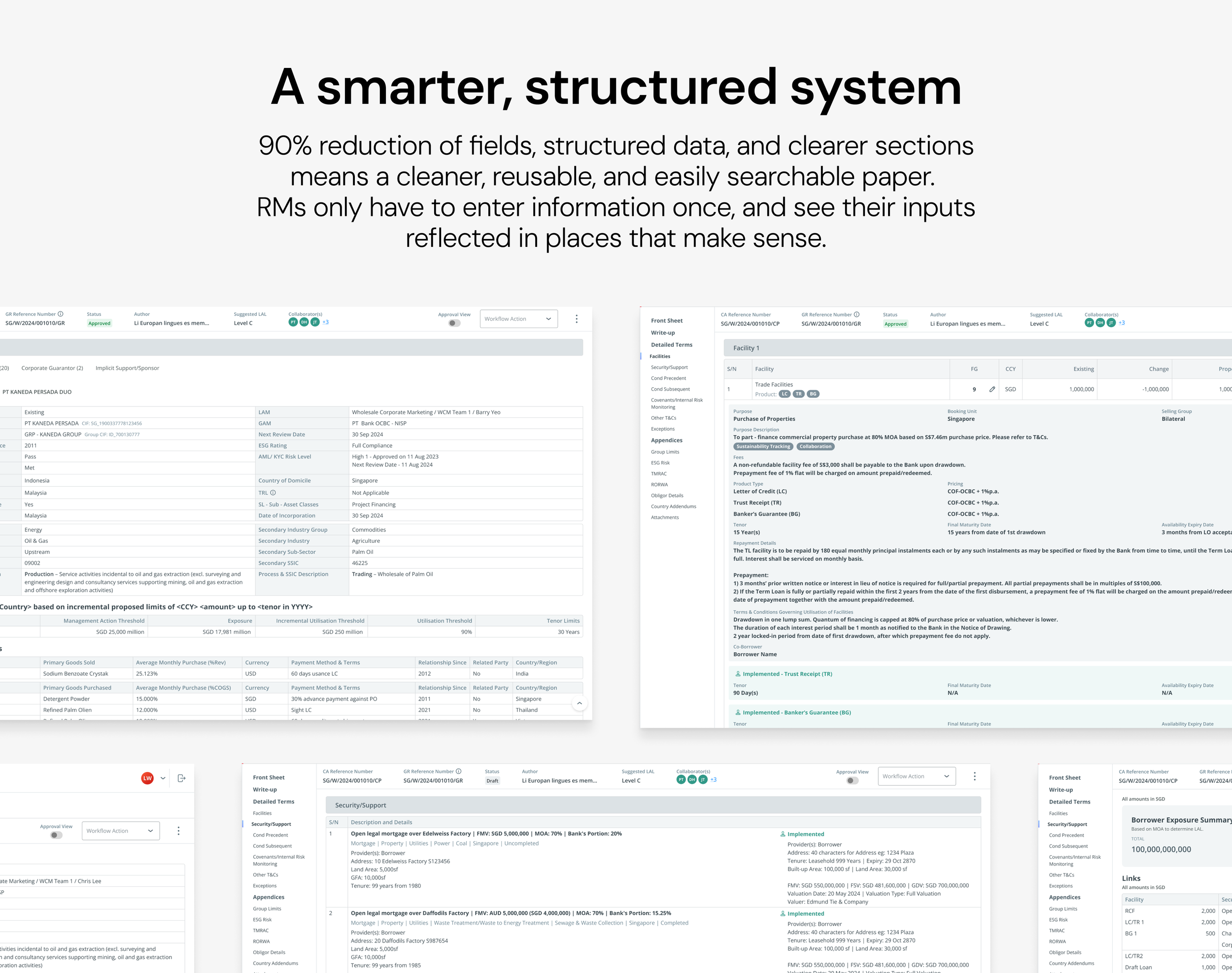

OutcomeEffectively shortened credit turnaround time by codifying policies and best practices and removing manual entries, hand-offs, and maker checker processes

100% reduction of externally maintained files

90% reduction of manual input

100% reduction of returns due to Data Quality/formatting issues

Reduction of maker-checker processes

Challenges

Effectively, we were inheriting a project that had:

5 previous project owners

cost the bank millions of dollars in manpower

been running for over 3 years

repeatedly interviewed RMs and Approvers

and had nothing to show for it.

Understandably, the new project directors wanted to see results fast and were highly sensitive to any discovery processes that had already been done before. Their biggest priority was to show progress every other month - this meant that delivery was set to a high priority.

To solve this, the project sponsor formed a new cross-functional department that included business, tech, operations and design resources. The project management team was completely overhauled, existing RMs were pulled from their BAU and turned in Product Owners overnight, and tech folks were made fully dedicated to the department.

The newly minted POs were expected to lead the build of the platform and provide the business and technical requirements based on their experience as RMs of varying industries. Two credit approvers were also brought over to the department as visiting consultants. They would spend 1 day a week with the department to help provide the business requirements of the Approvers, and drive any conversations needed with policy.

This combination of a newly formed team and the project’s past failures meant that:

training and guidance was needed for new POs to understand the role and scope of a product owner, plus understand what working in an agile environment means

design team had to adapt how discovery was conducted on both users and a complex business

project processes and ways of working had to be established

time had to be spent adjusting to the new environment

Overcoming challenges

The design team attempted to set up meaningful meetings and workshops as a way to get the project going, and to understand how we might work together and kick off the massive build before us. We established roles and responsibilities, and guided stakeholders to put forth the vision and principles that would guide the newly formed department.

Noticing the different preferred ways of working, we later split the designers to each service two or three product owners, and left the designers on how they wanted to manage their product teams. This allowed the flexibility and speed to adapt to each product owner’s schedule and preference while maintaining a standard of design thinking within each team.

We also adapted the discovery process. Unlike the well known quip that “you are not the user”, our POs actually were the users, though they did not represent all of the users. Short of going through a ill-received round of discovery, we relied on the POs to get the base cut of the solution out, then validating the solution with a handful of eyes outside the team.

During design sessions, I relied heavily on whiteboarding with the PO and BA (if there is one) to discover the business, understand the user’s thinking and motivation, system and policy constraints. This ensured the stakeholders could quickly see progress, while we learned of the business and validated that we were building the right thing.

People, Process, Policies, Platforms - how is it all connected?

Coming on board to the project, we had a clear directive to re-build an existing system from the ground up. Through our discovery and validation of the credit journey and proposed solution, we understood more about how the company operated, the processes involved, how policy played a significant part to manage risk and core legacy systems used by all users in the journey.

By understanding each of these levers, we (most importantly) understood why the problems we were trying to solve came about in the first place and the relationship between the actors, systems and processes.

For example, we discovered underlying attitudes that drove a handful of approvers’ behavior, which in turn causes them to take action; which in turn causes more unnecessary work for the relationship managers, which in turn causes more work for other approvers and credit admin staff.

By understanding this relationship, we were able to target the root of the problem accurately and meaningfully and explain why we did what we did. This is important because it allowed us to secure buy-in from the stakeholders and users who were impacted by the change. In digital transformation projects, change management is important to support users through a major transition of their way of working.

Key Takeaways

Through the two years of working on a very complex enterprise product with a unique team set-up, some of the key takeaways that I have as a designer includes:

Knowing how to make the trade off between engineering for performance and designing for delight

“Simple” does not always mean usable; our jobs is to understand the complexity to make the solution less complicated - not remove or avoid the complexity.

In specialized domains, understanding the context (of users, systems, processes) is paramount.

Understanding ambiguity will always be part of the job, and knowing when to take action goes a long way.